Tax Information

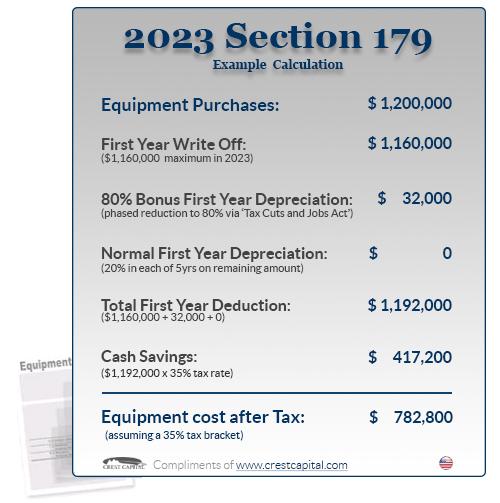

Section 179 maximum Deduction is $1,160,000 for 2023 and beyond.

May 20, 2021,

Please note that to be eligible for a 2023 Section 179 deduction, the eligible equipment must be purchased and put into service by midnight 12/31/2023. It is not enough to simply buy the equipment. Please keep supply chain issues and delivery times in mind when buying or using Section 179 Qualified Financing , as there are currently no plans to waive the “put into service” requirement.

IMPORTANT: The 179 deduction can provide significant tax relief for this tax year. Act now to select and order your equipment , arrange to finance if needed, and have everything delivered and in place by year-end.

Partnering with DuraProHealth.com for your equipment investment is a Winning Strategy. We provide dental professionals with an affordable alternative to high-priced dental equipment. Specializing in refurbished dental equipment, affordably priced new equipment, and digital imaging equipment, we make it possible to realize significant savings.

Strategic equipment investments for your business could significantly reduce your tax liability and cost of ownership.

Section 179 Deduction

What this could mean for your business:

Instead of depreciating a newly acquired asset over several years, the Section 179 deduction allows a business to take a 100% current year deduction of the full purchase amount up to $1,160,000 limit on capital purchases.

For more information visit Section179.org .

Savings Calculator

Cost of Equipment:

Tax Bracket of:

| Section 179 Deduction | $0 |

| 50% Bonus Depreciation Deduction | $0 |

| Regular First-Year Deduction | $0 |

| Total First Year Deduction | $0 |

| This Year's Potential Tax Savings | $0 |

| Final Equipment Cost | $0 |

This calculator is for example purposes only. Dental Planet, LLC is not a tax advisor, so please consult your tax advisor for specific details.